The Rise of the Live Music Industry in Southeast Asia

Published

Neo Hui Yun Rebecca analyses the rising demand for live music shows in Southeast Asia and how regional countries can tap into this opportunity.

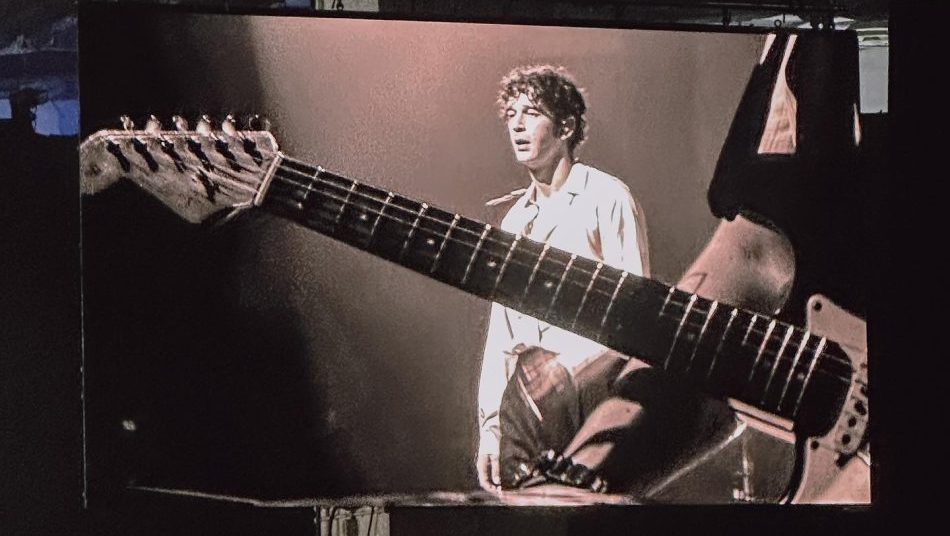

Long snaking queues of hopeful fans waiting to purchase concert tickets; virtual queues that ticked up to millions, tickets that were sold out in record timing – these were stories that constantly appeared on various social media platforms and news outlets this year. With the world reopening its borders to resume activities hit by the COVID-19 pandemic, the live music industry has slowly grown in prominence, with millions of fans competing to get their hands on limited tickets for their favourite bands or singers. This phenomenal rise has made its way into Southeast Asia, where many international bands and singers are beginning to organise regional tours to reconnect with their fans.

Famous Korean boyband BTS singer Suga, for instance, added an additional third night for all his concerts in this region due to overwhelming demand. British band The 1975 added a second show in Singapore after the first show was sold out within 30 minutes. The music industry has successfully reintegrated itself into the economy and has proven to be a strong economic driving force post-pandemic, facilitating a series of benefits that come along with these concerts.

A quick look at the number of concerts happening in 2023 highlights an interesting trend: the preference for international artists to hold concerts in certain countries within Southeast Asia. Singapore, Indonesia, Thailand, Malaysia, and the Philippines are among the top choices for most international artists’ Asia tours. Singapore, in particular, is a dominant destination of choice. This was amplified this year, with the announcement of Singapore as the only Southeast Asian country for Taylor Swift’s concerts. Similarly, Coldplay announced six shows in Singapore versus just one show each in other Southeast Asia countries. Singapore’s developed infrastructure, strong interconnectivity with the region, together with its stable governance and strong security measures such as crowd control and anti-terrorism protocols are some of the factors that have enabled it to be a popular choice for international artistes.

Analysts have calculated the benefits these concerts will bring to Singapore before and during the show periods. Within hours after the sale of these concerts’ tickets, overseas fans secured flight tickets and hotel accommodation to Singapore. Agoda reported an 8.7-fold increase in search for accommodation in Singapore during Coldplay’s concert period, with the surge driven by users in neighbouring countries such as Malaysia and Indonesia. Klook Singapore even launched ‘Experience Packages’, which included two tickets to Taylor Swift’s concert and a night’s stay at one of the over 40 hotels available to choose from. The majority of sold-out tickets were sold to concertgoers from the region, in particular the Philippines, followed by Indonesia and Malaysia.

Experts have since predicted that these two concerts could boost the overall hotel occupancy rate in Singapore by at least 5-8%, based on the assumption that at least 30% of concertgoers would be foreign visitors. Similarly, analysts predicted that the Coldplay concert could bring an estimated revenue of S$96 million to Singapore, assuming that overseas fans would stay an average of three days and spend around S$1,600 on purchases related to the concert. Overall, these concerts are seen as new economic drivers as they can boost tourism in the country, generating more revenues from tourist spending.

With such immense benefits accompanying the organisation of such concerts, it is not surprising that countries within Southeast Asia are competing to secure the opportunity to bring these big names into their country. However, there are barriers to bringing more of such acts into some of the less developed Southeast Asia countries. Infrastructure limitations, financial constraints, clashes in ideology or culture, and permit issues are some of the reasons for the stark disparity in the number of shows among Southeast Asian countries. Vietnam, for example, lacks large venues that can hold crowds of 30,000 – 50,000 people, making its market too small for some big-ticket international names to host their concerts there. This puts the country at a disadvantage to ASEAN neighbours such as Indonesia and Malaysia, which boast of bigger concert halls seen to be more attractive.

Other problems have led to a disparity in the holding of shows by foreign acts across Southeast Asia. While Indonesia was able to secure Coldplay for a concert in Jakarta, it was unable to extend this to more shows due to issues with licensing and permit applications. Moreover, clashes in cultural values and ideology also influenced the band’s decision to have fewer shows. Objections from religious groups such as Persaudaraan Alumni (PA) 212 in Indonesia against Coldplay’s lead singer Chris Martin’s support of the LGBTQ+ community also impacted the situation. Similarly, political conservatives like Parti Islam Se-Malaysia (PAS) in Malaysia have also taken issue with the band, citing that Coldplay could promote a culture of deviance. While the respective governments have defended Coldplay’s upcoming concerts, calls to cancel the concerts are still being raised within these communities.

Besides limitations within the host country, external factors are making it harder to host such concerts. International artists are increasingly emphasising sustainability in the planning of their concerts. Coldplay, for instance, has indicated that a country’s green strategies are part of its decision on where to hold their concerts. Some requirements include whether there is public transportation to the concert venue and the usage of renewable energy to power the concert lighting. All this requires a certain degree of technological capability which may not be available in less developed Southeast Asian countries. Apart from this, the high cost of organising such concerts is another deterring factor. Bringing in popular stars such as Maroon 5, Taylor Swift, and Rihanna requires at least US$2 million dollars from producers to cover the cost, which includes security, hotels, transportation, and other expenses set by the artistes. The need for large sums of capital to support these concerts effectively removes some countries from hosting the bigger concerts, causing this uneven distribution.

That being said, Southeast Asian countries are looking for new solutions to increase their standing in bidding for these concerts. Indonesia, for instance, has agreed to relook its performance permit process, aiming to simplify it through digitalisation. Individual concert organisers have stepped up to reduce the environmental impact of hosting concerts. Live Nation Philippines is planning shuttle services to ease concertgoers’ difficulty in reaching concert venues. Zepp Kuala Lumpur’s investment in its own venue in a shopping mall at LaLaPort Bukit Bintang City Centre has garnered interest among popular J-pop artists, increasing its standing as an attractive venue for more internationally renowned live shows. Even though government measures have been put in place to support this new industry, the majority, however, still stem from individual initiatives, mainly at a business-to-business level between music event organisers and artistes. Organisers would have to devise their own strategies in improving the performance’s experience for the audience. As such, much less has been done on the collaborative front, be it between music event organisers with the host country and even among Southeast Asian countries to better support the needs of these live performances.

Southeast Asian countries should aim to work collaboratively to support the rise of this industry. This could be a new direction for the region as Southeast Asia has already created some fame through its prolific music festivals such as the Good Vibes Festival in Malaysia, We The Fest in Indonesia, and It’s the Ship in Singapore, where overseas visitors fly into this region to enjoy music. All this proves that, taken as a whole, there is a sizeable market in Southeast Asia, especially with the current music tourism trend where fans are willing to spend money to fly to countries to catch a live glimpse of their favourite stars. It might be more beneficial if all countries in the region could work together to overcome existing challenges. By supporting the region through developing suitable infrastructure, such as making investments in bigger concert venues with improved audio-visual technology as well as streamlining ticket sales to even out the distribution, individual countries can boost the region’s overall reputation in hosting international concerts and music festivals. This will attract artistes to select Southeast Asia as their chosen destination region, not just individual countries. While there are challenges in adopting country level cooperation, resolving this barrier would enable every country in the region to enjoy the spillover benefits from these concerts and generate a win-win situation for all.

This, however, is still a grand plan in the making and much more needs to be done to ensure that existing challenges can be mitigated. It is undeniable that there is a demand for live music performances in Southeast Asia, given that the younger generations are more exposed to different genres of music through streaming platforms such as Spotify and are willing to spend the money to get an experience of music events found in other parts of the world. In all sense, the rise of the live music industry will become more prominent in the future and Southeast Asian countries would need to come together to ensure that they do not lose out in the race for these renowned performances.

Editor’s Note:

This is an adapted version of an article from ASEANFocus Issue 2/2023 published in September 2023. Download the full issue here.

Neo Hui Yun Rebecca is a research officer in the Indonesia Studies Programme, ISEAS - Yusof Ishak Institute.